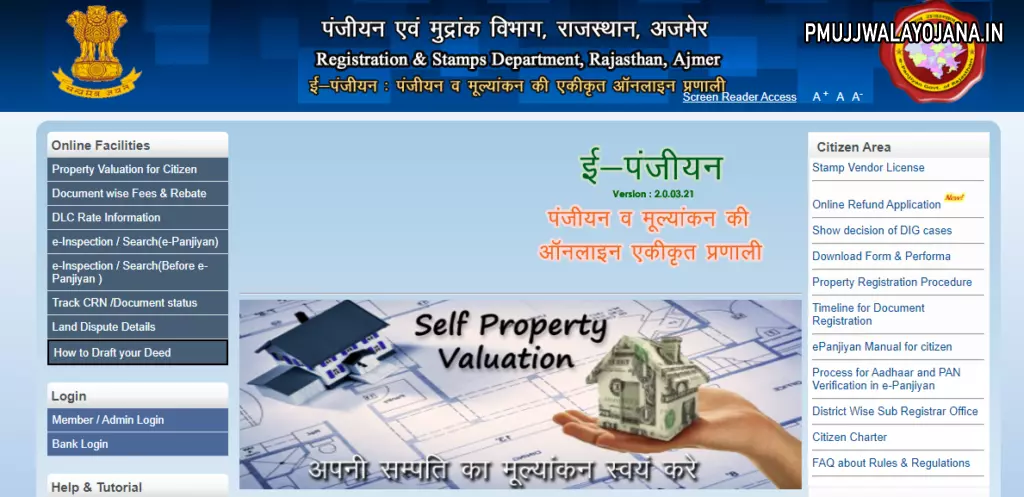

The IGRS Rajasthan and Epanjiyan Rajasthan websites are available to the public for a variety of real estate-related services such as property assessment, stamp duty, registration fees, rules governing transactions, etc. Read the article below to know about how to access Rajasthan’s citizen services and the IGRS website

What is IGRS Rajasthan?

The Epanjiyan Rajasthan Registration and Stamps, also known as the Inspector-General of Registration and Stamps—IGRS Rajasthan—is in charge of collecting taxes from real estate transactions and other related activities in order to fund the development of the state. Citizens can use the IGRS Rajasthan office in Ajmer to take advantage of a variety of services. The Epanjiyan Rajasthan is in charge of registering properties and handling a number of other operations. In this essay, we’ll go over the e-Panjiyan Citizen Services in-depth, including Rajasthan Registry Download.

E Dharti Portal – Apna Khata Rajasthan

Objective of IGRS Rajasthan

The following is the purpose of the government’s IGRS Rajasthan website:

- To carry out the Registration Act of 1908’s provisions.

- To alter Rajasthan state law’s stamp-related laws.

- To deliver a transparent, effective, and user-friendly system.

- To enhance state revenue through stamp duty and registration fees.

- By visiting www.epanjiyan.nic.in, you can access the Registration and Stamps Department of IGRS Raj’s services.

Epanjiyan Rajasthan: Services Available

Citizen services onepanjiyan include:

- Property valuation

- Document wise fees & rebate

- DLC rate information

- E-Inspection/ Search e-panjiyan

- Online time slot booking

- Track CRN/document status

- Land dispute details

- Guidelines for citizens to get draft sale deed report on e-registration software

Epanjiyan: Property Valuation for Citizens

By visiting the official Epanjiyan website, epanjiyan.nic.in, you can learn the precise value of your IGRS Rajasthan property. Select “property value” from the menu on the epanjiyan Rajasthan website’s left side. The next page will be opened for you.

- Next, depending on your needs, input your phone number, the verification code, and click “Fresh value” or “Modify valuation.”

- On the e-Panjiyan website, enter your information for a new valuation, including the type of location, and choose the document choice for a sale deed.

- Keep in mind that this option is found under the DLC Rates option on the IGRS Rajasthan website if you are looking for property valuation.

- Enter the Tehsil, district, and SRO information on the epanjiyan Rajasthan website.

- You will be directed to a different page on epanjiyan Rajasthan where you must enter information such as your location, colony area, plot number, etc.

- Add information such as built area, floor type, etc. to the website’s added value section.

- After selecting a commission, the property’s value will be shown. You can store this information by selecting “save property details.”

- By inputting the challan number and the OTP that you receive on your registered mobile number, you can obtain the Citizen Reference number as part of the epanjiyan Rajasthan services for alter valuation.

- To amend a finalised document, enter the citizen reference number and request an OTP to your registered cellphone number.

You will be directed to a different page that has both the DLC rates (old) and the DLC rates (new). You will be taken to the Epanjiyan Rajasthan Registration and Stamps Department website when you click on DLC rates (new), where you must then proceed as described above.

IGRS Rajasthan- Epanjiyan Document-wise Fees and Rebates

Visit the official E Panjiyan Rajasthan website at http://www.epanjiyan.nic.in to learn more about IGRS stamp duty and Rajasthan property registration details, including fees. The difference in stamp duty between men and women is typically between 3 and 6 percent.

IGRS Rajasthan– Epanjiyan DLC Rate Information

The minimum property value required for the registration of a sale of a plot, apartment, home, or piece of land is known as the DLC rate (or District Level Committee rate). On the IGRS Rajasthan website, click DLC pricing to see these charges. Visit https://igrs.rajasthan.gov.in/dlc-rates-status-all.htm to view DLC rates (old). You can access this information by clicking the DLC rate information link on the left side of the Epanjiyan Rajasthan registration and stamps portal.

To examine the DLC rates, including the old and new charges, you must click on the district.

Ashok Gehlot, the chief minister of Rajasthan, promised a 10 percent reduction in the DLC rate when he presented the state budget for the years 2024–2024. Additionally, the registration fee for apartments costing up to Rs 50 lakhs has been decreased from 6 percent to 4 percent.

Epanjiyan: Documents Required for Registering a Property

- Sale deed copy showing proof of ownership.

- Lease deed in case the terms and conditions time exceed more than a year

- Release deed in case of ancestral property identification

- Map of the property

- PAN card

- Form 60

- Photograph

- Supported property documents

IGRS Rajasthan- How to Register Property?

Follow these procedures to register your property on the e-Panjiyan website:

- Open the official websiteof Epanjiyan Rajasthan.

- The home page will be displayed on the screen.

- Go to the ‘Property Valuation’ link on the epanjiyan website.

- Enter your captcha code and cellphone number, then click “Fresh Valuation.“

- You will arrive to the next page.

- In this field, enter information about the document’s location, kind, district, subtype, SRO, category, and Tehsil.

- On a subsequent screen, you must provide information such as your location, colony area, property area, and address.

- Enter the building area or the floor type in the additional value section.

- Next, select commission, and the measured value will appear on the display. You can now “save the property details” to find out how much the land is worth.

- The next step is to go to the Registration and Stamps Department of Rajasthan’s e-Stamp page and compute the stamp duty.

- Keep in mind that, in addition to the stamp duty and registration fees, one must also pay the registration and stamps department in Rajasthan the CSI, the surcharge, and, if applicable, any penalties.

- To move on to the party information, click the next button.

- Type of presenter, party, category, gender, name of the party, ID proof, address, and contact information should all be entered.

- Once the document has been saved, upload all the documents to the e-Panjiyan Rajasthan website, click Done, and then Exit.

- Use the e-GRAS portal at https://egras.raj.nic.in/ to pay the stamp duty and registration fees.

- If you have a user name and password, log in on the eGRAS page to pay an e-stamp to the registration and stamps department of Rajasthan.

- If you do not already have a user name and password, register by providing the necessary information.

- Select the Rajasthan Department of Registration and Stamps.

- Fill in the e-Challan application’s details.

- Click on Submit after paying the stamp duty and registration fees using a debit or credit card.

- After paying the registration fees and stamp duty, the application is submitted on the e-panijyan website.

- To visit the Rajasthan Sub Registrar’s office for the Registration and Stamps department, choose a time slot.

- the CRN number and OTP that you will get on your registered mobile number, and then click “Enter.”

- On the day of the appointment, go to the Sub Registrar’s office (SRO) with the fee receipt and CRN number.

- Utilizing the CRN number, data verification will be carried out after you arrive at the Registration and Stamps Department of Rajasthan office.

- If you chose a manual payment option, as opposed to an online payment method, pay the fees in cash or with a check at this point, and the registration procedure will be complete.

Online Time slot Booking with eStepin

- To register the document, you can set up an appointment online at e panjiyan Rajasthan.

- Visit https://epanjiyan.nic.in/stepin/booking.aspx to get started.

- On the epanjiyan Rajasthan website, you will be required to submit information in addition to your contact information and name, such as your district, sub-office, registrar’s chosen day and time, CRN, and OTP.

IGRS Rajasthan: eStamp Verification

- To get e Stamp Rajasthan verification services, log on to the official e Panjiyan Rajasthan website and select the ‘E-citizen’ page.

- By selecting the option and continuing, you can use the e-Stamp Rajasthan verification.

- On the e-Panjiyan Rajasthan website, select the state name from the drop-down menu, then select the certificate number, stamp duty type, certificate issue date, session ID, etc. to verify the certificate.

- You must contact the persons on this list if you want to use the e-stamp Rajasthan services.

- Track the status of your documents.

- Simply log on to the epanjiyan official website and enter the CRN or document number to access any tracking facility.

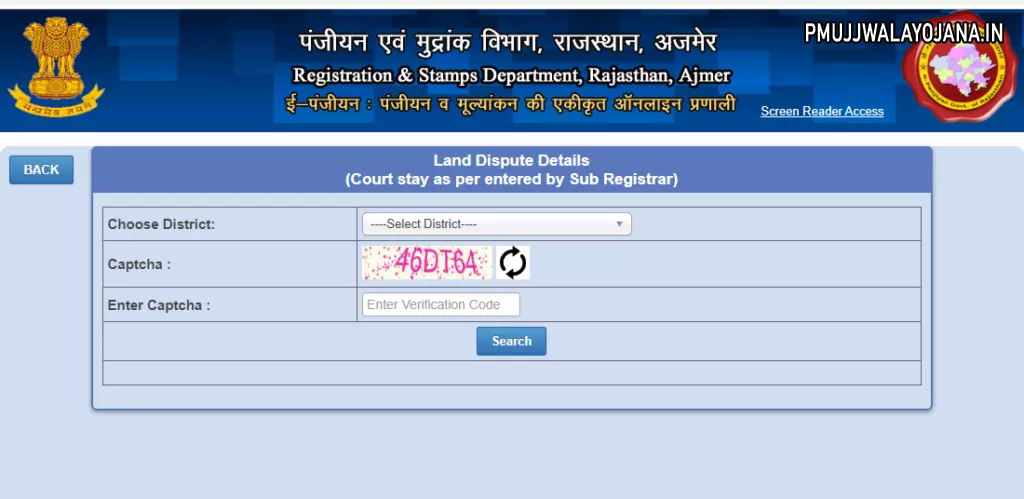

IGRS Rajasthan: View Land Dispute Cases

- On the epanjiyan website, you can also view information regarding land disputes.

- Simply click the Land Dispute Details link provided on the epanjiyan landing page’s left side.

- On the e Panjiyan Rajasthan website, you will be prompted to select the district. Following your pick, your screen will show a comprehensive list of dispute situations.

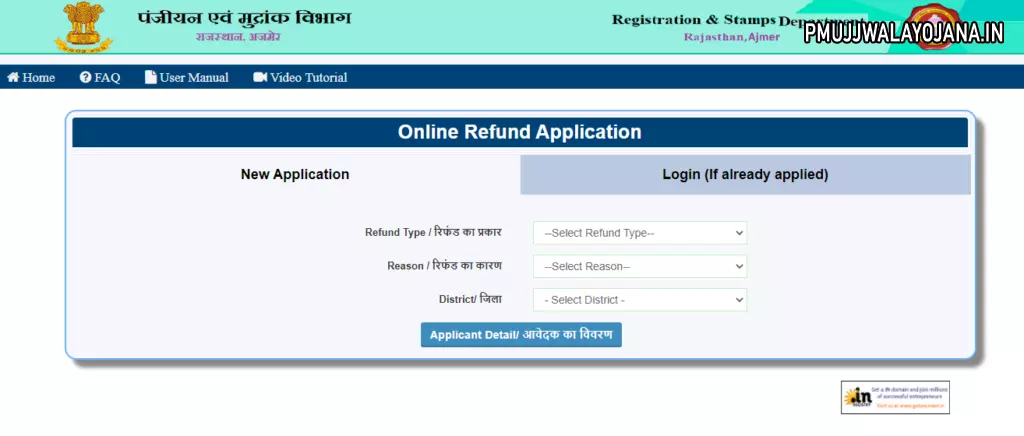

Online Stamp Refund Epanjiyan Rajasthan

- You can find a “Citizen Area” in the left-hand column of the main epanjiyan Rajasthan website.

- You will be taken to the following e panjiyan page if you choose to go to the “Online Refund Application” section under this.

- Choose the stamp duty, registration fee, or both from the drop-down box to specify the details of the refund type in the case of a new application.

Choose the reason from the dropdown box after that. Among the causes are:

- Effected by the same instrument between same parties

- Misused stamps (Sec 61)

- Non Acceptance of any office

- Not executed due to death

- Spoiled stamps

- Stamps not signed by anyone party

- Stamps not required for use (Sec 63)

- Stamps used as instrument void in law

- Other

- After choosing the district, click on the applicant’s detail link, fill out the form, and then click “Add.”

- If you have previously requested a refund, click on login to access the form below.

- Enter the password, captcha code, and refund token number in this field, then click “View Status of the Online Refund Application.”

IGRS Rajasthan: Grievance Redressal

- Through the facilities provided by IGRS Rajasthan and Sampark, you can file a complaint or check on the status of your complaint. Follow these procedures to access this:

- Open the IGRS Rajasthan’s official website.

- Go to the E-citizen tab in step two.

- Go to “Grievance” to start the procedure.

- As an alternative, you can also visit this direct link by doing so.

- As seen in the image above, click the “Lodge your Grievance” link to submit a complaint to IGRS Rajasthan. The IGRS Rajasthan department has so far handled 91.6.14 lakh cases out of the 90.56 lakh cases that have been reported, for a disposal rate of 98.86 percent.

Note the following:

- You must provide IGRS Rajasthan with all relevant information in point form.

- Provide your contact information and supporting documentation so that the IGRS Rajasthan officials can reach you and verify the complaint.

- You may also mention in the post any previous complaints you have to the IGRS Rajasthan.

- The plea should not be entered in court.

- Complaints that are private, public, or directed at an IGRS Rajasthan state employee are all appropriate.

- Keep the IGRS Rajasthan complaint number available for future reference.

- If the complaint lodged by you is false or the facts are wrong, IGRS Rajasthan shall hold the complainant liable.

- Since Sampark is not the RTI portal, concerns relating to the right to information are not taken into consideration.

- Scan the file at 150 output pixels per inch.

- You can reach Rajasthan Sampark via email at rajsampark@rajasthan.gov.in or cmv@rajasthan.gov.in, as well as by calling their toll-free number 181.

Epanjiyan: How do I use the IGRS Rajasthan to authenticate my PAN card and Aadhaar?

The procedure for PAN and Aadhaar verification in e Panjiyan is mentioned.

- On the day of the appointment, go to the Sub Registrar’s office (SRO) with the fee receipt and CRN number.

- Utilizing the CRN number, data verification will be carried out after you arrive at the Registration and Stamps Department of Rajasthan office.

- If you chose a manual payment option, as opposed to an online payment method, pay the fees in cash or with a check at this point, and the registration procedure will be complete.

IGRS Rajasthan Benefits for Citizens

The IGRS Rajasthan website not only assists citizens in saving time, effort, and money, but it also improves the convenience of conducting business. The e Panjiyan Rajasthan website increases transparency while minimising human interaction. Through the IGRS Rajasthan portal, important property-related information is now accessible from anywhere in the world.

IGRS Rajasthan Benefits for Officials

Officials desired a modification that would result in a better grievance procedure. This adjustment has been made possible by the IGRS Rajasthan. Additionally, the time spent handling these complaints has decreased, freeing up officials to concentrate on finding answers rather than managing them.

Epanjiyan Contact information

You can contact the department at:

Registration & Stamps Department

Nodal Officer : Sh. Sunil Bhatia, Joint Director (Computer)

IG, Registration & Stamps Dept, Head Office, Ajmer

Phone no: 0145-2971208

Mobile no: 8209786099

FAQs

E-stamping: What is it? A computer-based programme called “e-stamping” can assist you in paying the government’s non-judicial stamp duty. Where on the IGRS Rajasthan website can I get a list of the sub-offices? registrar’s Go to the E-Citizen tab >> Sub-registrar list after logging in to the official website to view the list. Can I use IGRS Rajasthan to pay my land tax? The e-GRAS portal must be used to pay any tax or other amounts due under the Act.