CERSAI Portal – The CERSAI was created by the government to prevent fraud in situations where properties are used as collateral for loans. According to Section 20 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act of 2002, the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) was established (SARFAESI Act). Section 25 of the Companies Act of 1956 grants it a license. Read below to get detailed information related to the CERSAI Portal like highlights, objectives, CERSAI Ownership, Features of CERSAI, Steps to log in, Entity Registration, Registration Fees, Benefits, and much more

CERSAI Portal 2024

To stop fraud involving mortgages, CERSAI was developed. Fraudsters would frequently obtain multiple loans from different banks on the same piece of land. Such cases are checked through the CERSAI register. Under the 2013 Companies Act, CERSAI was established as a government-owned corporation. New Delhi serves as the home base for CERSAI. The Central Government, Public Sector Banks (PSBs), and National Housing Bank collectively own a majority of the shares in CERSAI (NHB). According to the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act of 2002, the CERSAI registration is covered (SARFAESI Act).

Financial institutions had a very difficult time learning about the encumbrances on a property before CERSAI. Due to the disjointed registration process, only the property owner knew whether or not the property was mortgaged, which made finding out exceedingly difficult. Even genuine buyers were unaware of the loans and liabilities associated with a property in the absence of CERSAI (Cersai Login). That caused legal difficulties and problems for those who purchased such houses. The public and financial institutions can both use the CERSAI Portal. The general public can only view information about equitable mortgages, though.

Some Relevant Searches

- IGRS AP Property Registration

- IGRSUP Property Registration

- IGRS Telangana

- IGRS Rajasthan

- IGR Karnataka

cersai.org.in Portal Details in Highlights

| Name | CERSAI |

| Full Name | Central Registry of Securitization Asset Reconstruction and Security Interest of India |

| Established by | Government of India |

| Objective | To stop fraud involving mortgages |

| Official Website | https://www.cersai.org.in/CERSAI/home.prg |

Objective of Portal

Some of the key objectives of the CERSAI Portal are as follows:

- The CERSAI’s primary function is to function as a registration system. It is charged with running and maintaining a KYC registry, which is controlled by the PML Regulations of 2005. (Maintenance of Records)

- More than 35 crore KYC records are stored in the Central KYC Record Registry.

- The online security interest register for India contains all the data on loans, making it easier for borrowers and lenders to acquire pertinent data.

- The government must be informed of all interest generated on any securities by banks. The CERSAI serves as a venue for submitting that data.

- The technology monitors fraudulent activity linked to equitable mortgages by offering data transparency.

- On encumbered or attached properties, the platform also provides court orders and attachment orders.

CERSAI Ownership

Although the central government now owns the majority of the company, the CERSAI stated in March 2024that since all of the central registry’s tasks are connected to banking activities, the Reserve Bank of India (RBI) might acquire the government’s 51% ownership in the company. Together with the National Housing Bank, state-run lenders State Bank of India, Punjab National Bank, and Bank of Baroda hold the remaining 49% of the CERSAI.

Features of CERSAI Portal

Some of the key features of CERSAI are as follows:

- Banks, housing finance companies (HFCs), and non-banking finance companies are involved in every aspect of CERSAI’s operations (NBFCs).

- Lenders can file security interests in movable, immovable, and intangible property at the central registry, among other things.

- A database of all the properties in India that have been mortgaged with banks is what the CERSAI login is

- To serve reporting entities of the RBI, SEBI, IRDAI, and PFRDA, the CERSAI also runs and maintains a Central KYC Record Registry (CKYCRR) as of 2016.

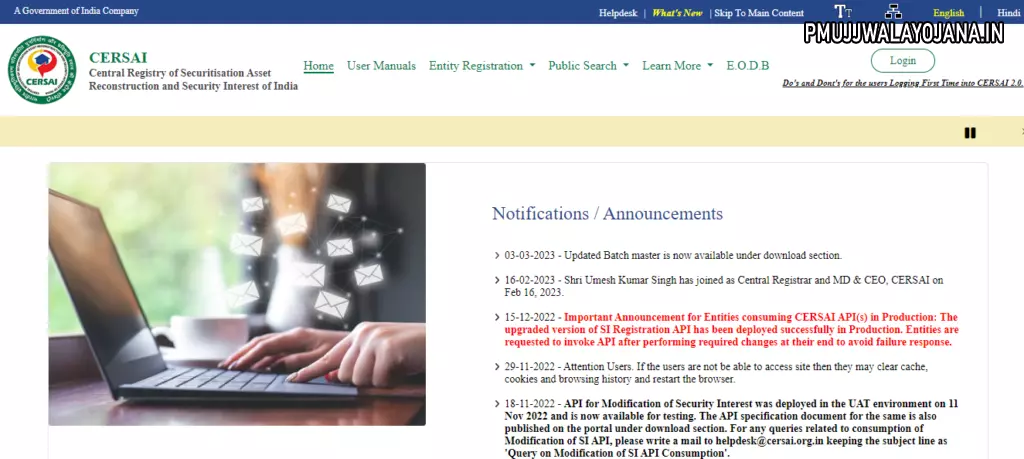

Steps to Login on the CERSAI Portal

To login into the CERSAI Portal, the user needs to follow the below-given steps:

- First of all, go to the official website of CERSAI

- The homepage of the website will open on the screen

- Click on the Login button

- The login window will display on the screen

- Now, enter the login id, password, and the captcha code

- Finally, click on the Login button to get logged in to your registered account

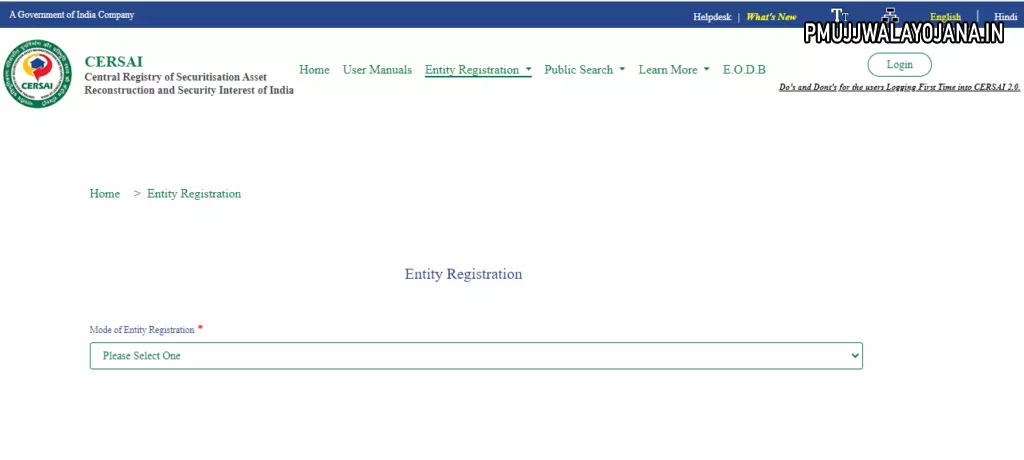

Steps for Entity Registration

For entity registration on CERSAI Portal, the user needs to follow the below-given steps:

- First of all, go to the official website of CERSAI i.e., https://www.cersai.org.in/CERSAI/home.prg

- The homepage of the website will open on the screen

- Click on the Entity Registration tab followed by the Entity Registration

- A new page will open on the screen

- Now, select the Mode of Entity Registration i.e.,

- CKYC

- Digital Signature

- After that, enter all the required details

- Finally, enter the captcha code and click on the Submit button

Registration Fees

For the registration of security interests, the CERSAI charges a fixed price. The cost to register with CERSAI ranges from Rs 50 to Rs 100. The fees are based on how much money has been borrowed and applied to the property.

| Transaction Nature | Fee payable (Excl. Tax) |

| Creation or modification of Security Interest in favor of secured creditors / Other Creditors | 100 rupees for a loan above 5 lakh rupees and 50 rupees for a loan upto 5 lakh rupees |

| Satisfaction of securitization or reconstruction of financial assets | 50 rupees |

| Satisfaction of any existing Security Interest | NIL |

| Securitization or reconstruction of financial assets | 500 rupees |

| Assignment of Receivables | 10 rupees for the assignment of receivables of less than 5 lakh rupees and 100 rupees for the assignment of receivables of 5 lakh rupees and above. |

| Search for a piece of information in CERSAI | 10 rupees |

| Condonation of delay up to 30 days for Assignment of Receivables | Ten times the basic fee, as applicable. |

| Satisfaction of registration on the realization of the receivables | NIL |

Benefits of Portal for Homebuyers

The options for property and real estate developer verification were restricted before the implementation of the Real Estate (Regulation and Development) Act, 2016. Under the guise of deceitful tactics and false promises, the homebuyers were tricked. The prospective homeowner may now verify whether the property they have shortlisted is free of any liabilities or hasn’t been used as collateral for a loan thanks to the CERSAI platform. Homebuyers not only save money, but they also avoid future tiresome legal difficulties.

CERSAI Database Updating and Maintenance

With the assistance of Indian banks and other financial organizations, the CERSAI database is updated. A bank is required to update the CERSAI database with new information each time it processes and disburses a loan. The database update is known as the Registration of Charges. Keeping an open database of encumbrances on properties is the aim of the Registration of Charges. Within 30 days of the loan’s completion, banks are required by law to give information regarding a disbursed loan. The Reserve Bank of India (RBI) will impose financial penalties on banking institutions if the CERSAI database is not updated